Did you recently pay taxes or fines online in Pakistan and need to download your CPR (Computerized Payment Receipt)? This receipt serves as official confirmation from the Federal Board of Revenue (FBR) that your payment has been received. Here’s a quick guide on how to download your CPR using two simple methods:

Get CPR Through Email (Recommended)

- Enter Your Email During Payment: When creating challan (PSID) online for tax payment, ensure you enter a valid personal email address in the designated section.

- Receive CPR Copy via Email: After successful payment processing, the FBR system will automatically send you a copy of the CPR to the provided email address.

A Computerized Payment Receipt (CPR) is an electronic document issued by the Federal Board of Revenue (FBR) in Pakistan to confirm the successful payment of taxes and duties.

Download CPR Online:

This method is useful if you didn’t provide an email address during payment or haven’t received the CPR via email. However, you will need the CPR number before downloading it.

If you know the PSID number, then you can easily find CPR number.

Find CPR Number from PSID Number:

In order to get Computerized Payment Receipt (CPR) number from PSID number, follow these steps.

-

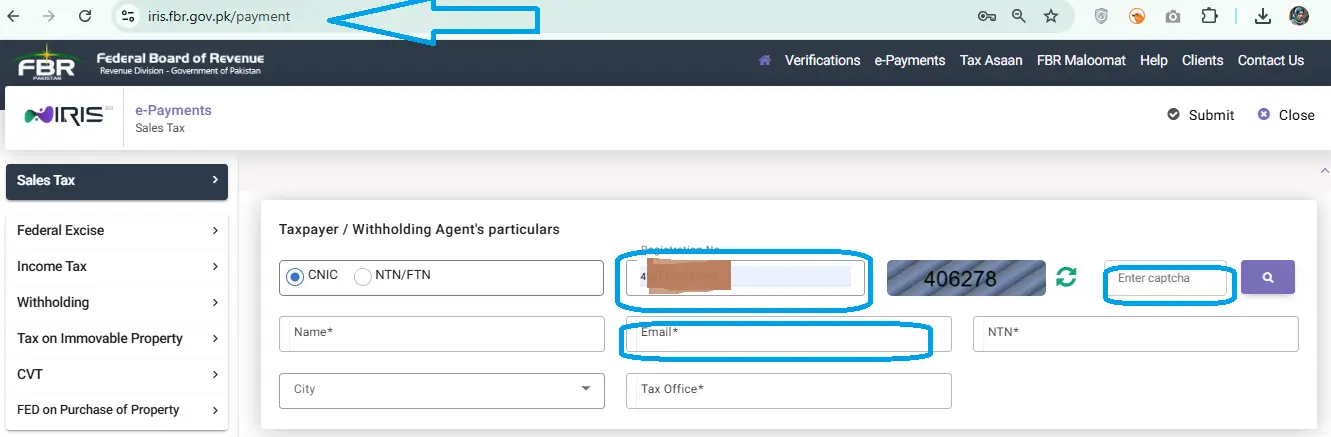

- Visit FBR Online Verifications or IRIS 2.0 on FBR website.

- Scroll down to Online Verifications.

- Select Payment Slip ID (PSID) / Computerized Payment Receipt (CPR) Verification on left menu.

- In Parameter Type select PSID.

- Inside Registration No. enter PSID number.

- Enter the displaying number in Captcha.

- Click on Verify button.

- You will get Computerized payment receipt number against the PSID number.

Downloading CPR Using CPR No.

Now, when you have CPR number available, you can easily download your CPR (Computerized payment receipt) online by following these steps;

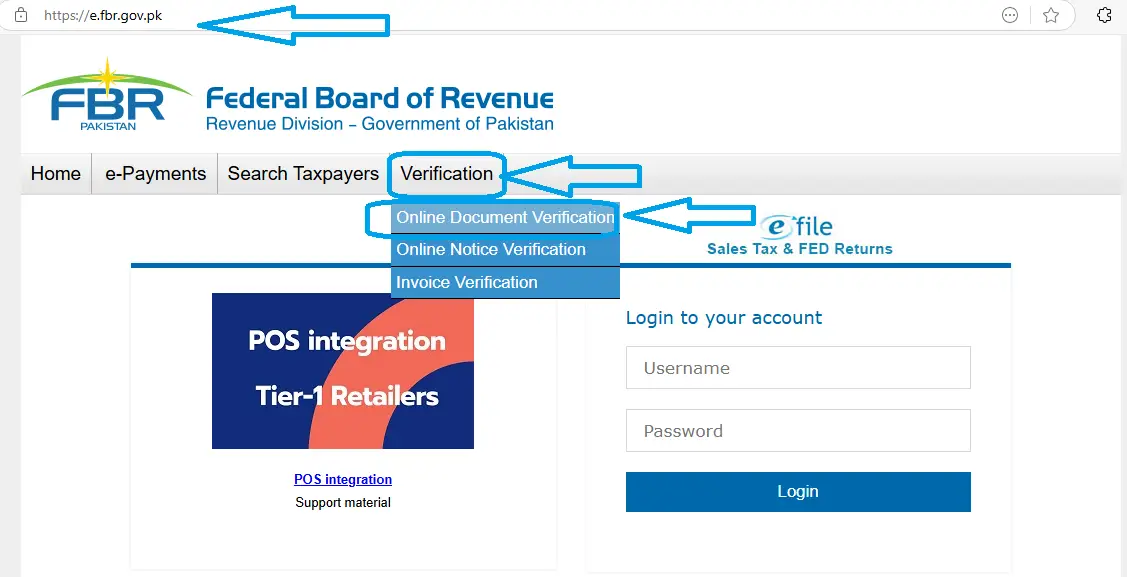

- Visit the eFBR – Taxpayer Facilitation Portal on FBR website.

- Under Verification Menu, click on Online Document Verification.

After selecting the Online Document Verification (as shown above)

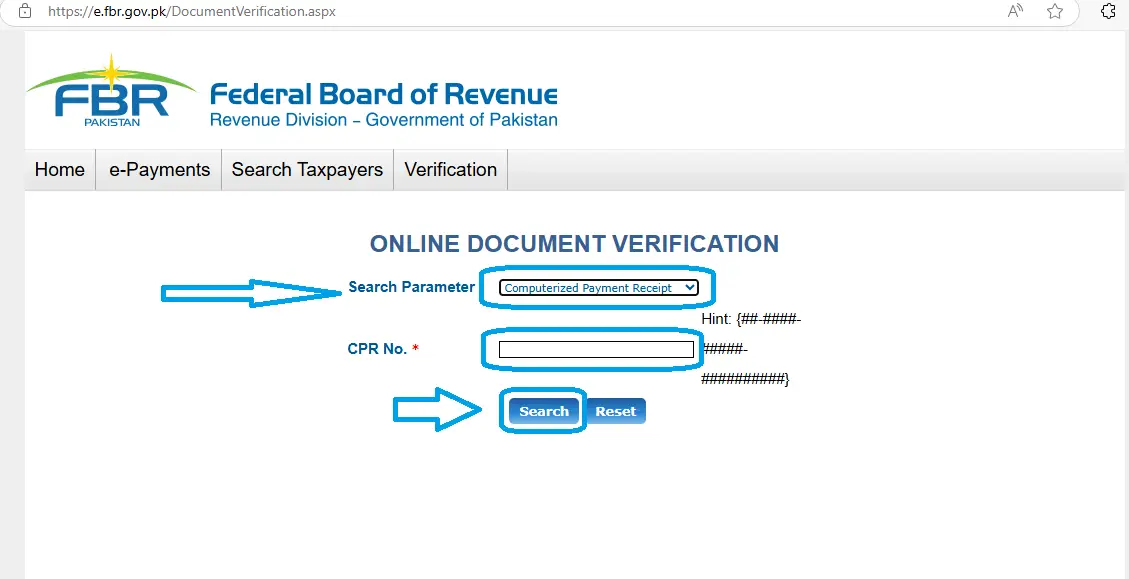

- Inside Search Parameter select Computerized Payment Receipt.

- Enter your CPR No. in the format IT-2024-01234-1234567890

- Click on the search button.

- Your CPR will be opened and downloaded in new tab or window of your browser.

Remember: Having your CPR readily available is crucial for record-keeping and potential future communication with the FBR. By following these simple steps, you can easily download your CPR and ensure you have proof of your online tax or fine payments in Pakistan.

Tax-fbr amounting to Rs,11781/- was paid through eSaulat ID 61708 vide their Receipt number 6170824061412130801 against Consumer vocher number 20014185037240613 on 24 June 24. Request send receipt. Thanks

Dear Sir, a locally purchased a 2nd hand device OPPO A54 Model CPH 2239, Serial number C19TGM8LEYTSHEJR alongwith it’s IMEIS Number(862366050654930& 862366050654922) and simcards linked with this device was stopped working/locked up due to non payment of tax-fbr amounting to Rs,11781/-. Tax-fbr amounting to Rs,11781/- was paid through eSaulat ID 61708 through their Receipt No.6170824061412130801 against Consumer Voucher Number 20014185037240613 on 14 June 24. Request CPR, which is required for unlocking of IMEIS.