The Federal Board of Revenue (FBR) has launched the Malomaat Web Portal, a powerful platform enabling citizens to access financial and transactional information available with the FBR. This portal, integrated with third-party data sources and in-house systems, serves as a transparent gateway for existing and potential taxpayers.

Purpose of the Malomaat Portal

The primary objective of Malomaat is to facilitate unregistered and existing taxpayers in understanding their financial footprint as recorded by FBR. Through this system, citizens can assess whether they fall under the taxable category and take the necessary steps to fulfill their national obligations.

Data Sources

The data displayed on the Malomaat portal is derived from two main categories:

- Third-Party Data: Information sourced from external institutions such as banks, vehicle registration departments, and property registries.

- FBR’s Internal Data: Data collected through taxpayers’ declarations, withholding statements, and the e-payment system.

This dual-source approach ensures comprehensive and accurate records, helping identify unregistered potential taxpayers and streamlining the tax collection process.

Key Features of the Malomaat Portal

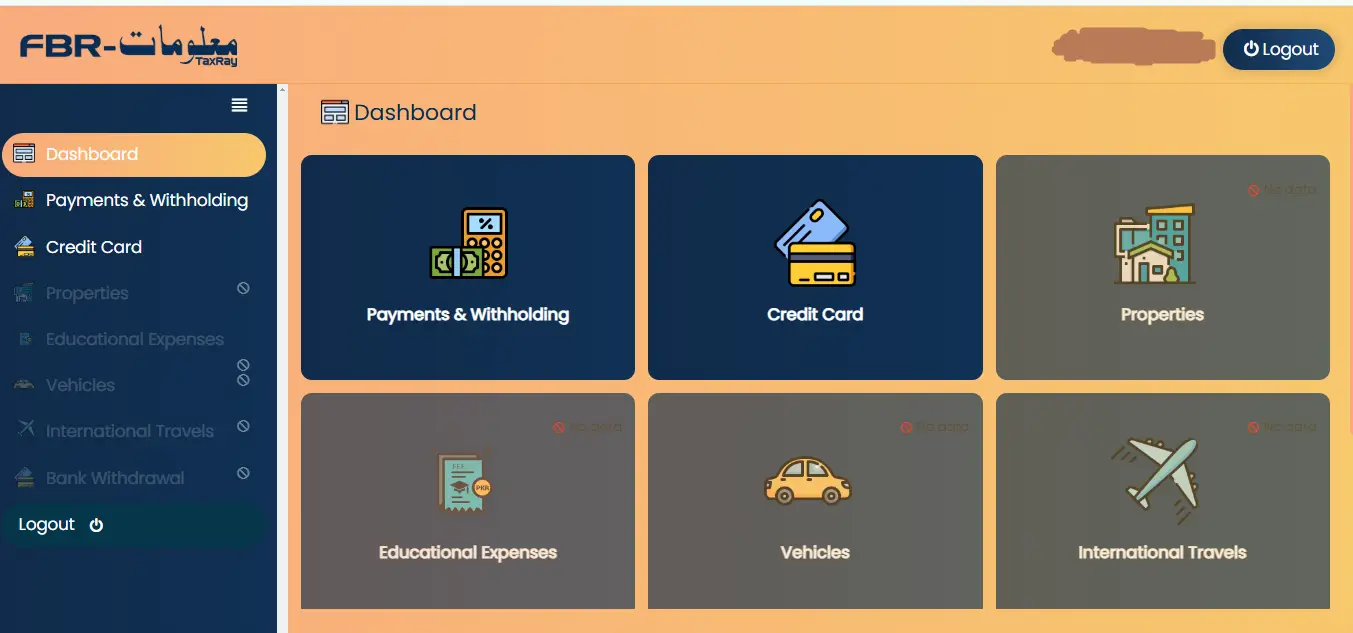

The Malomaat portal organizes information into easily accessible tabs and tiles, each representing specific financial activities. The current categories include:

- Withholding Data: Details about taxes withheld from various transactions.

- Vehicles: Records of vehicles owned or registered.

- Properties: Information about real estate holdings.

- Frequent Travel: Data on international trips, reflecting financial capacity.

- Debit and Credit Transactions: Financial activity, including:

- Credit card payments exceeding Rs. 200,000.

- Bank withdrawals surpassing Rs. 1 million.

- Educational Expenses: Insights into significant education-related payments.

As the FBR continues to connect its data warehouse with more financial institutions and departments, additional categories will be introduced to enhance transparency and accountability.

Registration and Access

Existing taxpayers can also access third-party data through their IRIS login, enabling them to compare it with their declarations for accuracy.

To access and enroll in the Malomaat portal, visit: Malomaat Portal Login

Continuous Updates

The data on Malomaat is regularly updated from both third-party sources and FBR’s internal systems, ensuring that users receive the latest information. This dynamic approach underscores FBR’s commitment to transparency and efficiency in tax administration.

You can also save the data in pdf file format or editable excel sheet for later offline viewing.

Call to Action

The FBR emphasizes that all major financial transactions are now within its purview. Citizens are encouraged to review their data on the portal and fulfill their tax obligations. This not only ensures compliance with the law but also promotes business transparency and peace of mind.

By leveraging the Malomaat portal, FBR aims to bring all liable citizens into the tax net, fostering a culture of accountability and responsibility. It is a step forward in strengthening Pakistan’s tax system and ensuring equitable participation in national development.