In Pakistan, your CNIC (Computerized National Identity Card) is a crucial tool for linking your identity with tax records. However, it’s important to note that FBR tax cannot be directly checked by CNIC alone. Your CNIC helps verify your identity for tax purposes, and you can use it to access relevant tax records through several methods. This article will guide you on how to track your taxes using your CNIC, including checking tax deductions, Active Taxpayer List (ATL) status, withholding tax certificates, and much more.

At TaxationPk—Your Trusted Tax Partner, we’ll walk you through all the methods for checking your tax information online and offline.

How Can I Check My FBR Tax by CNIC?

While you cannot directly check your FBR tax by just using your CNIC, the CNIC acts as a key identifier for linking you to your tax records. It is essential for the following:

- Checking Active Taxpayer List (ATL) status.

- Confirming tax deductions made by employers or service providers.

- Requesting withholding tax certificates from banks, employers, or clients.

- Verifying taxes paid using the IRIS 2.0 portal if you have a registered NTN.

How CNIC Helps in Checking Your Tax Information

Your CNIC is the key to accessing your tax records in Pakistan. While it doesn’t directly calculate taxes, it helps you track and verify the tax information linked to your identity. By using your CNIC, you can:

Verify Your Active Taxpayer List (ATL) Status

Your Active Taxpayer List (ATL) status is crucial, as being on the list reduces the rate of withholding tax on various transactions. You can easily check your ATL status using your CNIC:

- Online: Visit the official FBR website and enter your CNIC (without dashes). This will show if you’re listed as an active taxpayer or not.

- SMS: Send your CNIC to 9966 to receive an SMS response regarding your ATL status.

TaxationPk Tip: If you’re not on the ATL, ensure that your tax returns are filed to be added to the list, which will help you benefit from lower tax rates.

Obtain Withholding Tax Certificates

Withholding tax certificates are issued when tax is deducted at source from transactions such as salaries, bank interest, and property transactions. These certificates can be obtained from the following:

- Employers: Request a certificate from your employer to verify the tax deducted from your salary.

- Banks: If you earn interest or conduct specific transactions where income tax is deducted, your bank will issue withholding tax certificates.

- Service Providers: Telecom and utility service providers also deduct income taxes. You can request a withholding tax certificate from them.

- Property Transactions: If you buy or sell property, ensure the correct tax is deducted and request a certificate from the relevant authorities.

Quick Tip: Keep a digital or physical copy of all your withholding tax certificates for easy access when filing your tax returns.

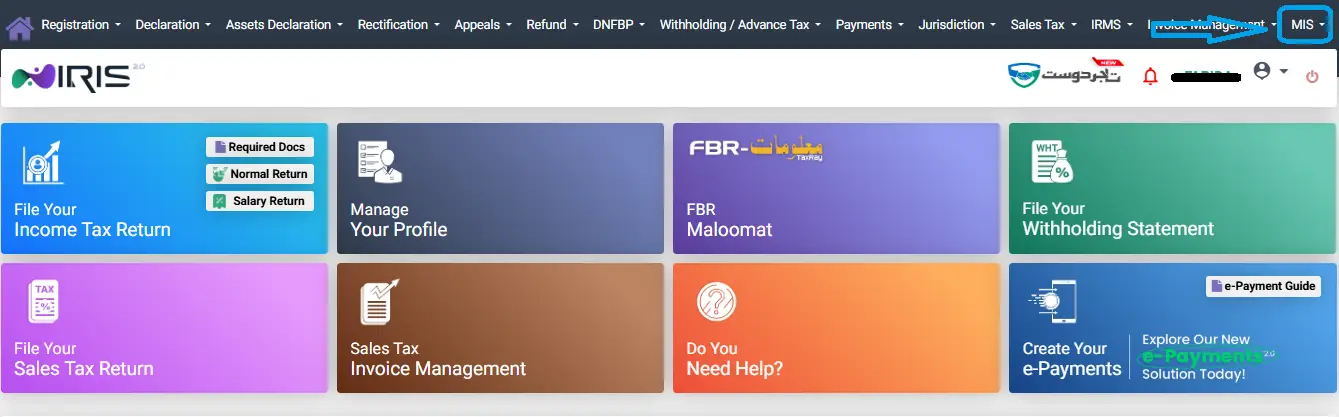

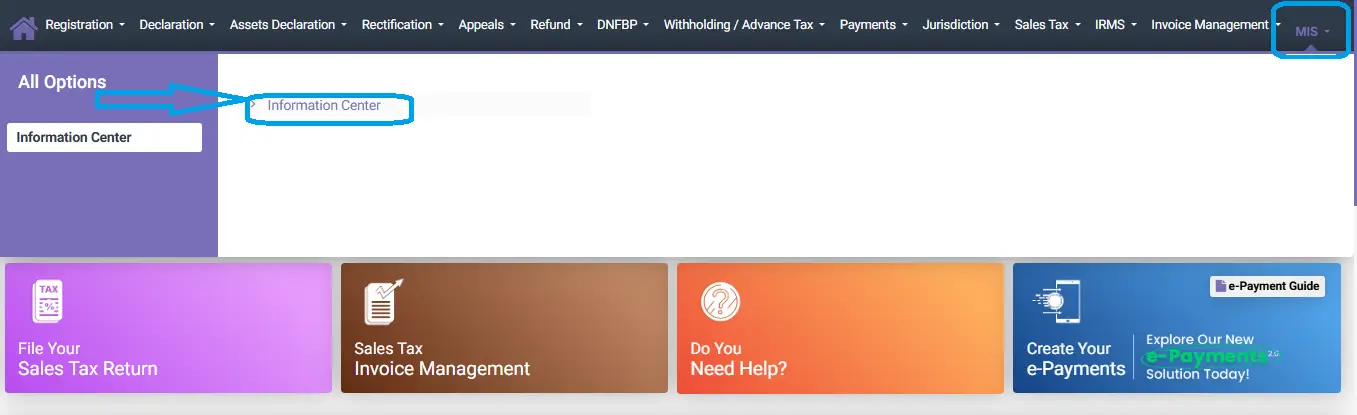

Use IRIS Portal to Check Tax Payments

The IRIS 2.0 portal is an official platform where registered taxpayers can view their detailed tax records, including taxes paid and returns filed. However, to use IRIS, you must have a National Tax Number (NTN) registered with FBR. Here’s how you can check your tax payments through IRIS 2.0:

- Login to IRIS 2.0. Use your CNIC (if you don’t have an NTN) to log in.

- Once logged in, you can view detailed tax information, including:

-

- Tax paid to FBR.

- Tax returns filed under your name.

- Tax refunds issued by FBR.

- Withholding tax details and much more.

TaxationPk Tip: Regularly check your tax records on IRIS to stay on top of your filings and payments.

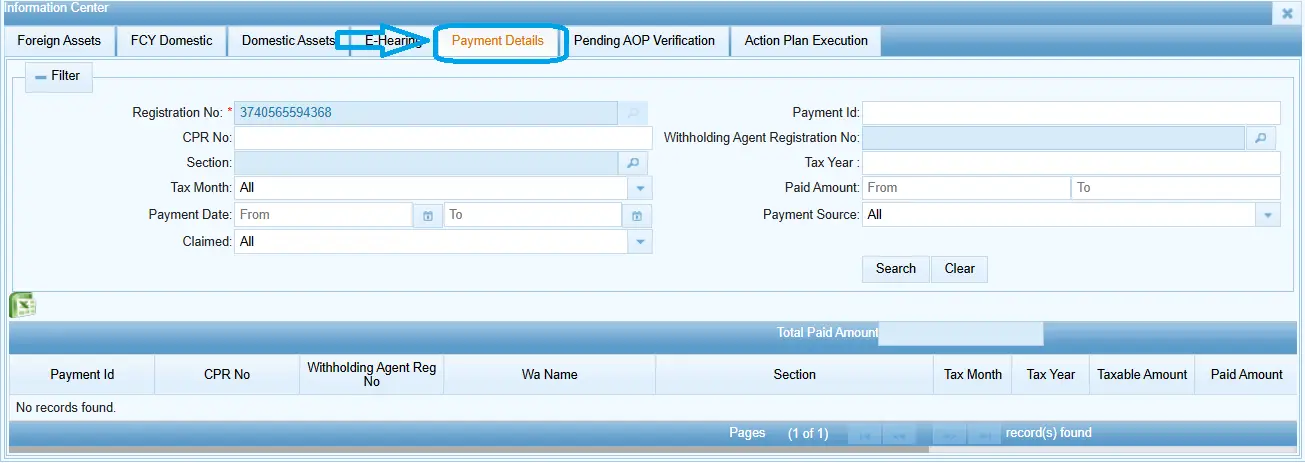

Check Taxes Paid on Property, Vehicle, and Token Payments

Your CNIC is linked to property and vehicle taxes, which are important for ensuring compliance. Here’s how to check these taxes:

- Property Taxes: Check the MIS for taxes deducted against your CNIC for property transactions including buying or selling of property. However it will not show the property taxes paid to the housing development societies here.

- Vehicle Taxes: MIS (Management Information System) will show the income taxes paid during the transfer of vehicle including the CVT amounts.

- Token Payments: However it is seen that the annual token tax paid on vehicle are often not represented here. May be FBR will update the system and that will be shown in the future, but as of today that is not the case. The payment is done or not can be verified by the Excise and taxation department

Quick Tip: Keep track of your property, vehicle, and token taxes to avoid penalties for late payments.

Request and Verify Tax Payments through Banks and Other Service Providers

You can also check taxes paid on specific transactions such as bank deposits, purchases, and service bills through:

- Bank Statements: If tax is deducted at source from your bank transactions, your bank statement will reflect this. Request a detailed statement from your bank for tax verification.

- Telecom and Utility Services: Utility service providers like electricity, mobile and internet companies also deduct taxes. As of now only a few Internet service provides are linked with MIS data. The internet Giant PTCL although provide online tax certificates those are not integrated with FBR. For which govt must take steps to ensure all the govt entities share data on one platform.

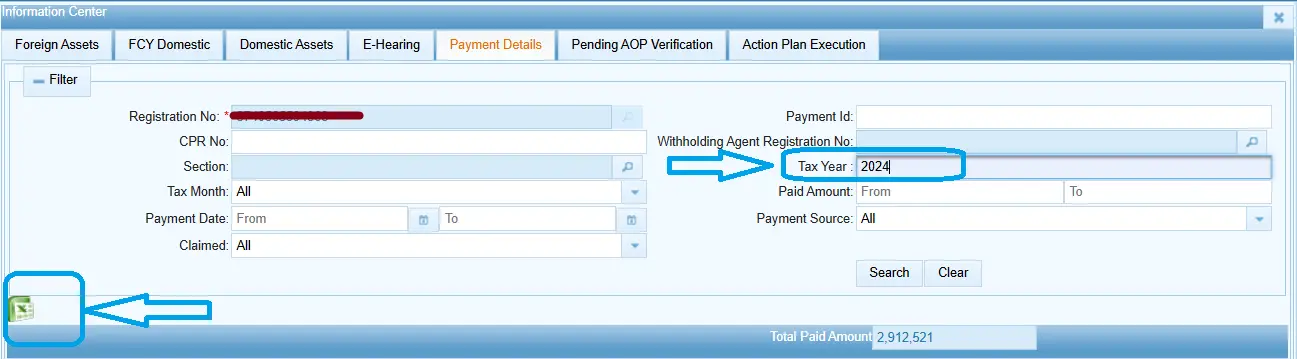

Here is a quick visual guide for you to follow to download the desired information:

TaxationPk Tips for Simple Tax Management

- Register Your NTN: Ensure your National Tax Number (NTN) is registered with FBR to gain full access to tax records and IRIS 2.0 portal.

- Keep a Record of All Certificates: Store withholding tax certificates and tax-related documents in both physical and digital formats.

- File Your Tax Returns on Time: To stay on the Active Taxpayer List (ATL) and avoid penalties, ensure you file your tax returns on time.

- Use Online Portals: Leverage the FBR’s official portals to track your taxes and verify payments.

- Consult a Tax Professional: If you’re unsure about your tax status or records, consider consulting a tax advisor for expert guidance.

To make this process easier, be sure to register your NTN with FBR and regularly check the IRIS portal for updates on your tax payments and filings. At TaxationPk, we are dedicated to helping you navigate the complexities of taxation in Pakistan, offering trusted guidance and resources to ensure you stay compliant.

For more insights, tools, and updates, visit News and Updates.