Adding salary as a source of income in your tax return is a straightforward process that ensures compliance with tax regulations. By following the correct steps, you can avoid common pitfalls and streamline your filing process. Here’s a detailed guide to help you navigate this procedure efficiently.

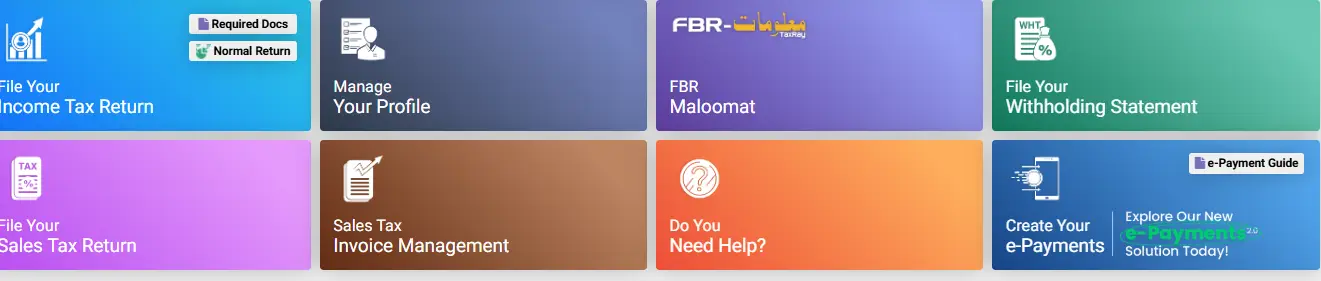

Log Into Your Tax Profile

Start by logging into your tax profile through the official tax portal. This portal is typically accessible online and requires your credentials, such as a username, password, or any unique taxpayer identification number provided by the authorities.

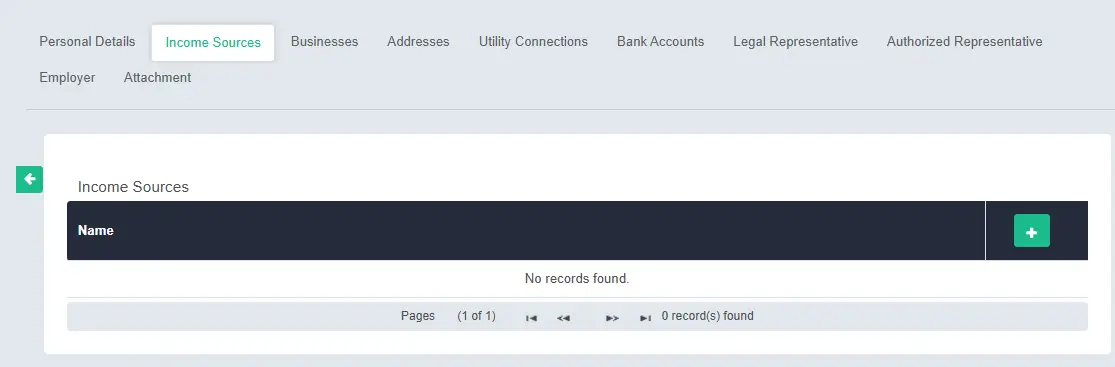

Once you are logged in, navigate to the section labeled “Manage Your Profile”

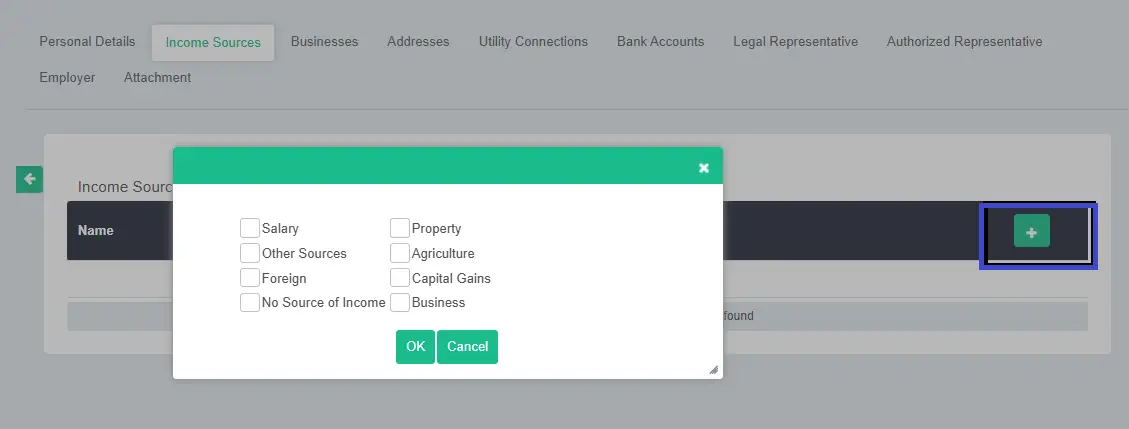

Here, select “Salary” as your primary income source.

If you have multiple sources of income, such as rental income, freelance earnings, or business profits, ensure that all relevant options are check marked to provide a comprehensive overview of your earnings. Keeping this section updated ensures the accuracy of your tax return and prevents potential audits or discrepancies.

Enter Employer Details

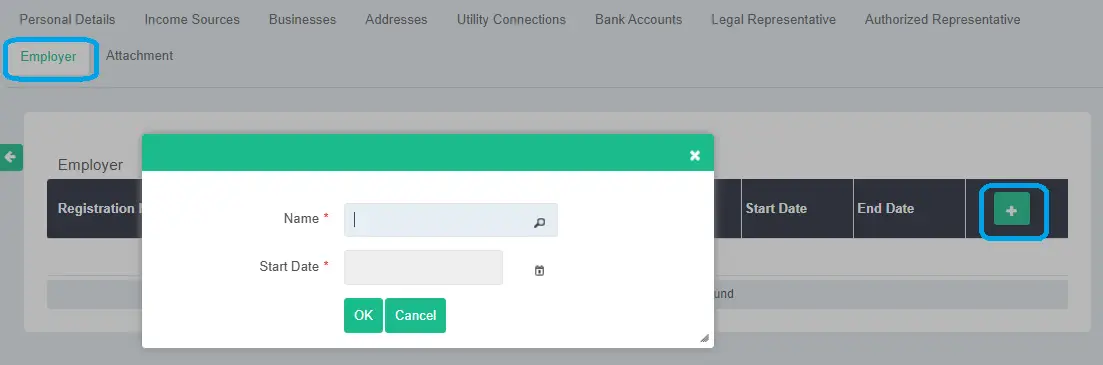

After selecting “Salary” as your income source, the next step is to provide detailed information about your employer. This process involves navigating to the “Employer” tab within your profile. Follow these steps:

- Enter the Start Date: Input the date when you began your employment with your current employer. This information helps establish the period during which your salary income was earned.

- Provide Employer NTN or Name: Enter your employer’s National Tax Number (NTN) or search for their name in the provided field. The system will cross-reference your input with its database and display the registered employer’s name.

Verify the displayed name to ensure it matches your current employer’s details.

Update Employment Details When Changing Jobs

If you change or switch jobs during the tax year, it is essential to revisit the “Employer” tab and update your information. Here’s what you need to do:

- Specify the End Date: Input the end date of your previous employment to close that record.

- Add New Employer Details: Provide the details of your new employer, including their NTN or name, along with the start date of your new job.

By updating these details promptly, you ensure that your tax profile remains accurate. This accuracy is particularly important if you switch jobs multiple times within a single tax year, as each employment period needs to be accounted for in your tax return.

Transitioning to a Business Venture

For those transitioning from salaried employment to self-employment or business ownership, it is necessary to update your income source in your tax profile. Change the category from “Salary” to “Business Income” and provide any additional details required, such as the nature of your business, registration details, and expected income.

Making this adjustment ensures your tax return reflects your current financial circumstances and allows you to take advantage of any tax benefits or deductions available for business owners.

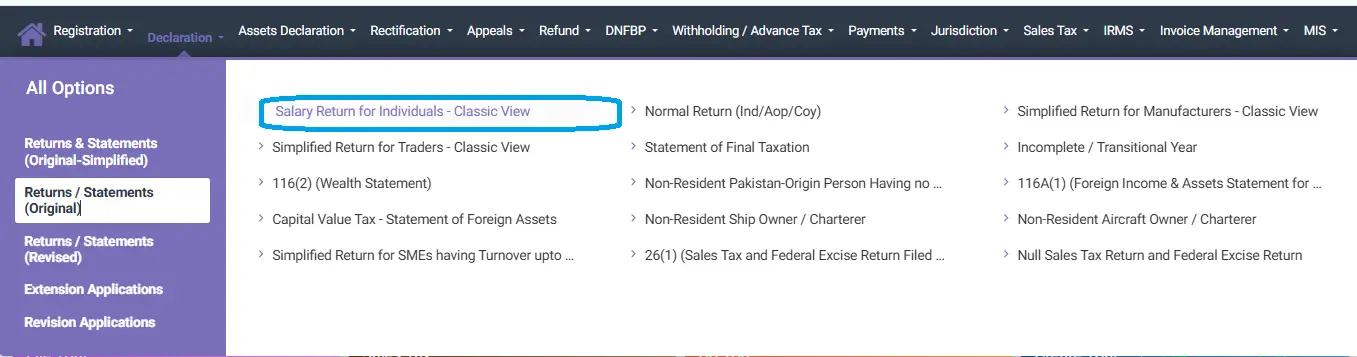

Use the Correct Form for Salary Tax Returns

Salary income requires a specific form designed to capture all the relevant details. This form often includes sections for employer information, monthly income breakdowns, and applicable deductions. Using the correct form not only ensures accuracy but also helps in claiming any deductions or allowances you might be entitled to.

Be sure to download the latest version of the salary tax return form from the official tax authority’s website. Forms may change annually, and using an outdated form could result in delays or errors in processing your return.

Tips for Accurate Filing

- Double-Check Your Information: Errors in dates, employer details, or income amounts can lead to delays or audits. Always double-check the information you provide.

- Understand Deductions: If you are entitled to any deductions, such as for retirement contributions, housing allowances, or medical expenses, ensure you include them in your return. These deductions can significantly reduce your taxable income.

- Consult a Tax Advisor: If you have multiple sources of income or complex financial arrangements, consulting a tax advisor can help ensure compliance and optimize your tax liability.

Pro Tip: Keep Your Profile Updated

Regular updates to your tax profile are crucial for maintaining accuracy and compliance. Aim to review and update your profile at least once a year or whenever there is a significant change in your employment status, income sources, or personal details. Keeping your profile updated can prevent last-minute rushes and reduce the likelihood of errors in your tax return.

By following these steps, you can ensure that your tax returns are accurate, complete, and compliant with the latest regulations. Whether you’re a salaried employee, transitioning between jobs, or moving into a business venture, keeping your tax profile updated and using the correct forms will simplify the filing process and help you avoid potential issues with tax authorities.