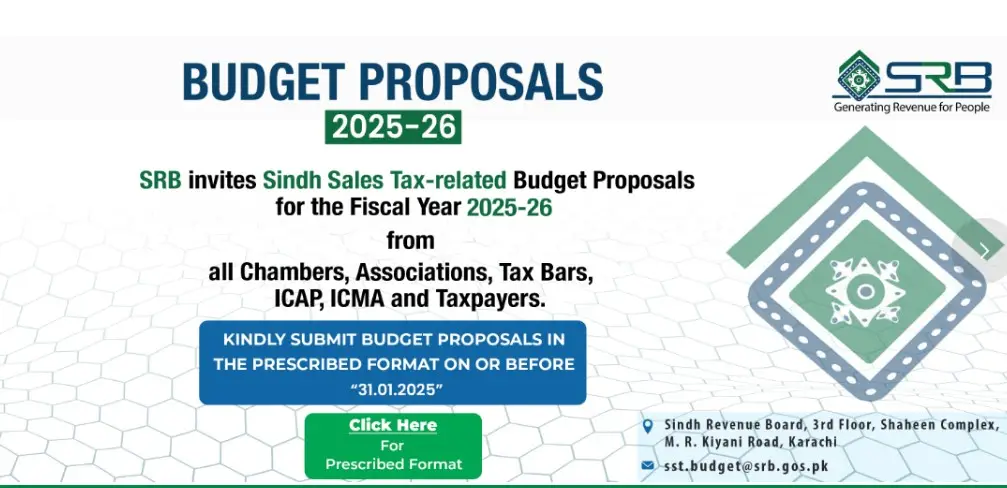

Karachi, Pakistan: The Sindh Revenue Board (SRB) has taken a proactive step toward inclusive fiscal planning by inviting stakeholders to submit tax proposals for the forthcoming Budget 2025-26. This initiative underscores the board’s commitment to fostering collaboration between the government, taxpayers, and industry representatives to design a taxation framework that is fair, efficient, and growth-oriented.

In its official announcement, the SRB highlighted that the proposals will focus on key legislative and procedural areas under the Sindh Sales Tax on Services Act, 2011. Specific areas of interest include:

- Sindh Sales Tax on Services Rules, 2011

- Special procedure rules covering withholding tax, transportation of petroleum products via oil tankers, and services provided by cab aggregators

- Online business integration measures

- Taxation on specified services

- Sindh Place of Provision of Service Rules, 2023

- Other notifications issued under the 2011 Act

The SRB is keen to incorporate stakeholder insights to refine these frameworks, addressing existing challenges while identifying new opportunities for broadening the tax base.

Inclusive Engagement with Stakeholders

As part of its collaborative approach, the SRB is reaching out to a wide array of stakeholders, including:

- Chambers of Commerce and Industry

- Business councils

- Trade associations

- Tax bars

- Professional accountancy bodies

- Individual taxpayers

This outreach aims to bridge gaps between policymakers and those affected by taxation policies. By fostering dialogue, the SRB intends to ensure that tax measures are practical, equitable, and aligned with the province’s broader economic objectives.

Submission Guidelines

Stakeholders have been invited to submit their written proposals by Friday, January 31, 2025. Proposals must follow a prescribed format to ensure clarity and consistency in evaluation. The SRB has encouraged submissions that:

- Simplify tax compliance processes

- Address sector-specific inequities

- Suggest innovative methods to expand the tax base

- Avoid imposing excessive burdens on businesses

This approach emphasizes the SRB’s dual objective of increasing revenue collection and supporting economic growth. Click here for the prescribed format for submission of proposals.

Transparency and Fairness in Taxation

The annual budget plays a pivotal role in Sindh’s economic development. By soliciting and incorporating input from diverse contributors, the SRB aims to create policies that are transparent, responsive, and forward-thinking. This participatory process is expected to address key concerns, improve compliance, and make the tax system more inclusive.

Building a Growth-Oriented Framework

The SRB’s call for tax proposals is a testament to its commitment to fostering a stable and growth-oriented economic environment in Sindh. Stakeholders now have a valuable opportunity to contribute to shaping the region’s fiscal policies, ensuring that they reflect the needs and aspirations of businesses and individuals alike.

By promoting dialogue and inclusivity, Sindh is setting a precedent for progressive fiscal governance, aiming for a taxation framework that not only meets revenue goals but also supports sustainable economic development.